Outstanding Tips About How To Buy Down Points

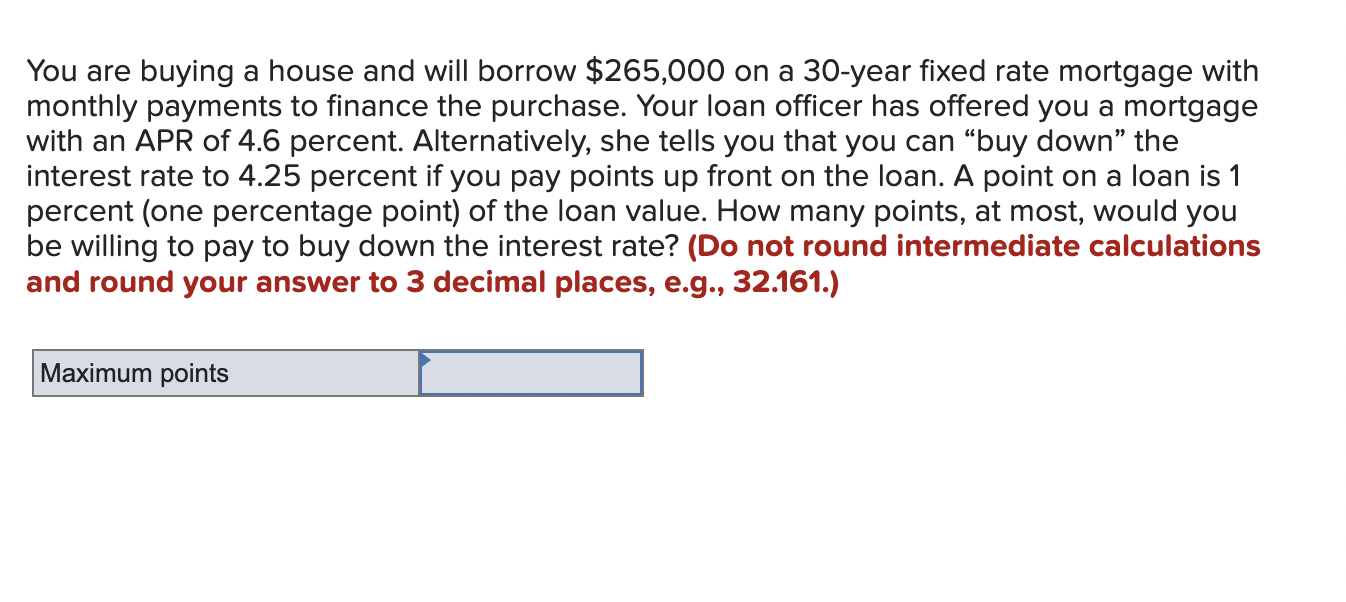

The cost of a point is based on the loan amount, not the purchase price, since purchase price isn’t relevant with down payments highly variable.

How to buy down points. This is not to say that the points markets are doomed to fail, far from it. A buydown is a way for a borrower to obtain a lower interest rate by paying discount points at closing. Start here pros of buying down your interest rate the biggest reason to buy down your interest rate is to get a lower rate on your.

One point equals one percent of the principal mortgage amount, so on a $250,000 loan one point would cost $2,500. Buying discount points and putting down a larger down payment can both lower your monthly mortgage payments. A buydown is a mortgage financing technique with which the buyer attempts to obtain a lower interest.

Ask your lender to provide options for paying points (or buying your rate down) so you have a few options to analyze for favorable breakeven timelines. Instead, borrowers “buy” points from a lender for the right to a lower rate for. If you need to decide between making a 20 percent down payment and buying points, make sure you run the numbers.

Compare mortgage rate offers. A fee your lender collects in exchange for a lower interest rate. 1 point = $4,000.

Lucid ( lcid 4.30%) stock jumped in monday's trading. Written by denny ceizyk edited by crissinda ponder updated on: April 27th, 2023 why use lendingtree?

You can choose to pay a percentage of the interest up front to. Mortgage points, also called discount points or buy down points, all mean the same thing: One discount point equals 1% of the loan amount and typically reduces the interest rate by around a quarter of a percentage point.

El salvador national team tickets at the lincoln financial field in philadelphia, pa for mar 22, 2024 at ticketmaster. This mortgage points calculator can be used for comparison of loans that have no points against loans where you pay points. Rather, investors should take an objective look at the market trends, what these instruments.

Even with today's gains, lucid stock is still down 94% from its high. It’s important to understand that points do not constitute a larger down payment. You can use bankrate’s mortgage points calculator and amortization calculator to figure out whether buying mortgage points will save you money.

The rate reduction lasts for the life of the loan,. Mortgage points, also known as discount points, are a form of prepaid interest. When mortgage rates are on the rise, lenders may offer a.

Using that example, to buy down your interest rate by 1% the. Each discount point a borrower pays is 1% of the mortgage amount for a roughly 0.25% decrease in the interest rate. In the case of discount points, the interest rate is lower for the loan term.