Out Of This World Tips About How To Reduce Deferred Tax Liability

The net tax liability is.

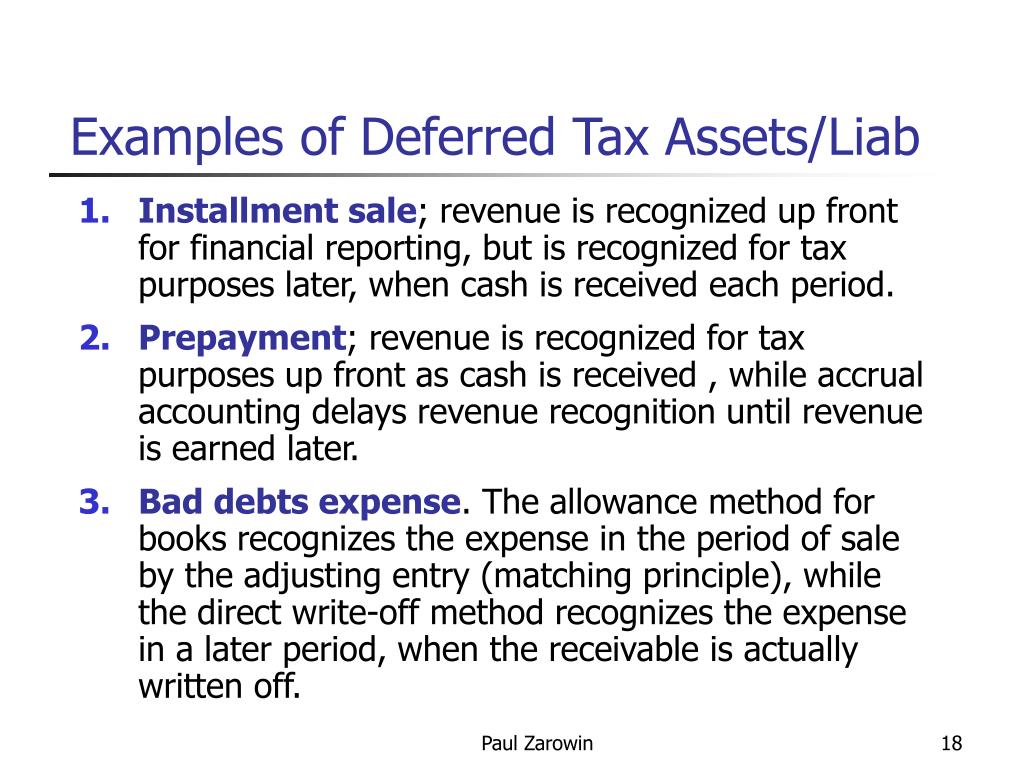

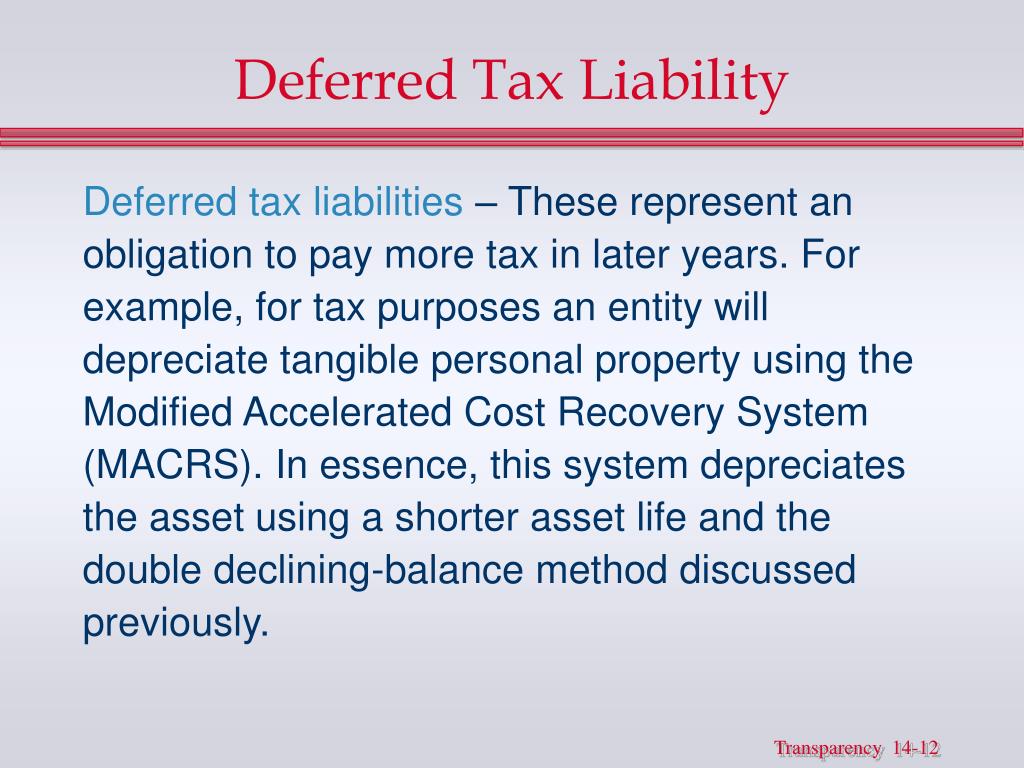

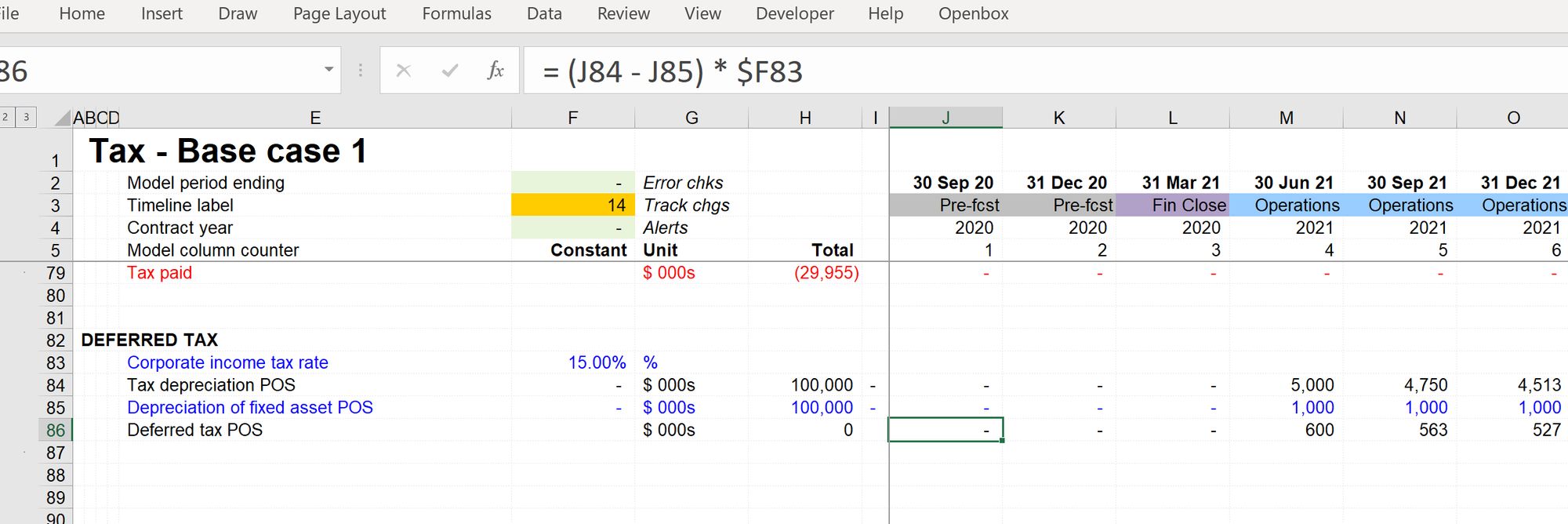

How to reduce deferred tax liability. It is the opposite of a. October 19, 2021 standard accounting methods and tax accounting methods have different sets of rules. Asset solution in year 1 the depreciation is $20,000 so the carrying value is $80,000 in year 1 the capital allowances are $50,000 so the tax base is $50,000.

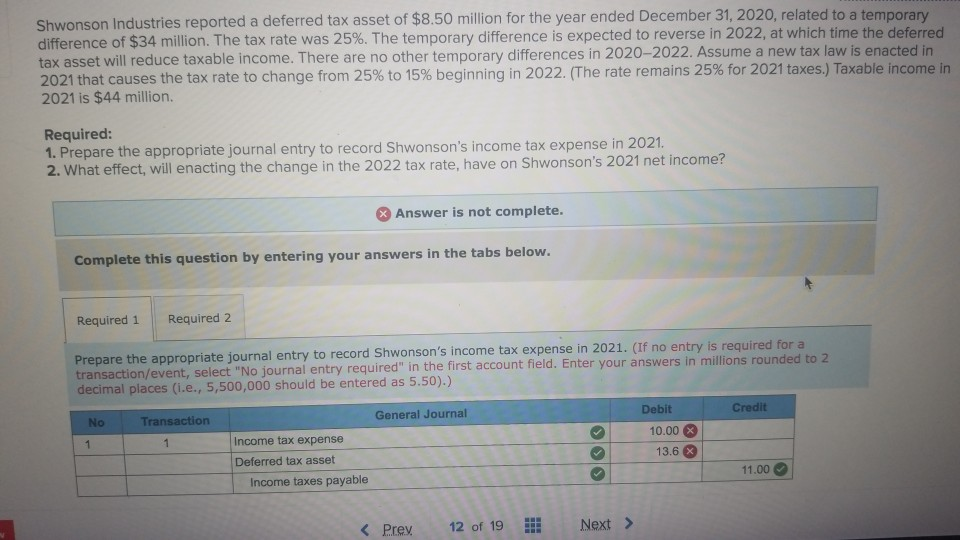

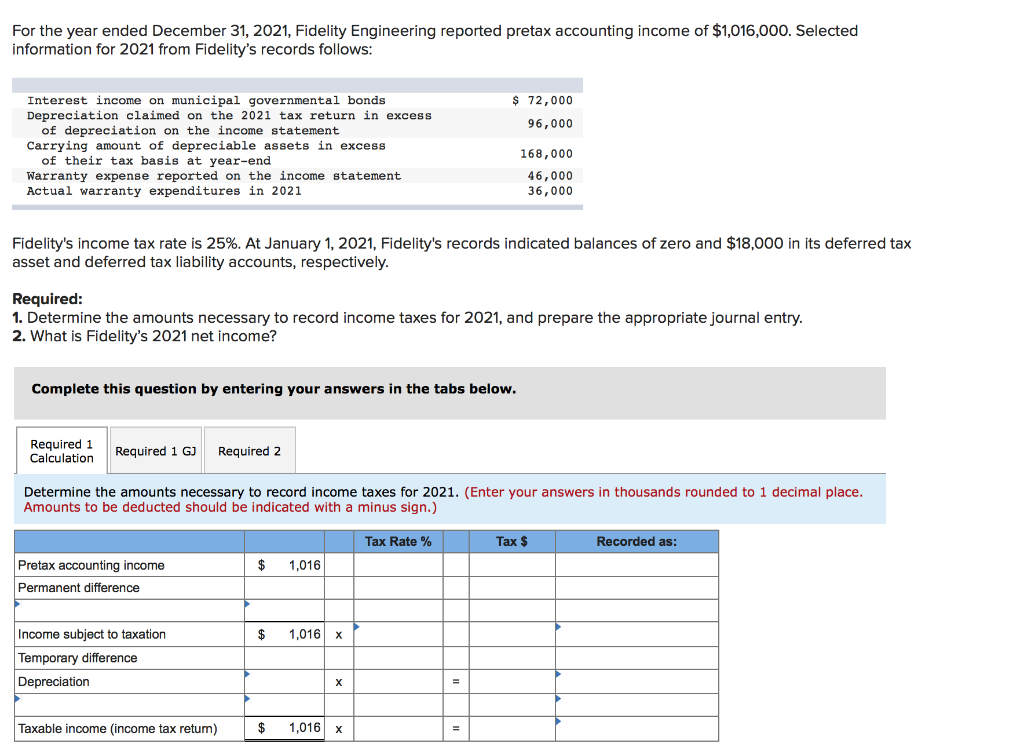

Deferred tax liabilities or deferred tax liability (dtl) is the deferment of the due tax liabilities. 10 min read contents [ show] deferred tax liability (dtl) or deferred tax asset (dta) forms an important part of financial statements. For example, deferred tax assets and liabilities can have a strong impact on cash flow.

Make sure you report all income—even savings account interest. Key takeaways a deferred tax asset is an item on the balance sheet that results from an overpayment or advance payment of taxes. The deferred tax liability now needs to be reduced from $100 to $65 and so is debited (a decrease) by $35.

The deferred tax liability will reduce when income tax expense is less than the income tax payable. Deferred tax liability journal entry example. Consequently, there is now a credit (a decrease) to the income tax.

After understanding the changes and causes of the deferred tax balance, it is important to also analyze and forecast the effect this will have on future operations. A source of cash is either a rise in deferred tax liabilities or a decrease in deferred tax assets. With respect to the timing of the reversal of a deferred tax liability, it is important to note that factors may be present which could result in a delay in the event (s) that give rise to.

It includes income, sales, property taxes and more. Deferred tax assets and liabilities are measured at the tax rates expected to be applicable during the period when the asset is realised or the liability is settled,. A company recognises deferred tax when recovering an asset or settling a liability in the future will have tax consequences (that is, will affect the amount of tax the company will.

We'll cover what exactly deferred taxes are, walk through deferred tax asset and liability examples, explain how to calculate and record deferred taxes, and. For instance, deferred tax assets and liabilities can significantly affect cash flow. Open an account 2 interactive brokers low commission rates start at.

1 sofi invest active investing with sofi makes it easy to start investing in stocks and etfs. Interest earned on your savings is classified as earned income by the irs. If you expect to receive a payment, you may have to pay taxes on it in the.

In other words, when the due tax will be paid in future years. An increase in deferred tax liabilities or a decrease in deferred tax. A deferred tax liability is a liability recognized when tax paid in current period is lower that tax that would be payable if calculated under accrual basis.

:max_bytes(150000):strip_icc()/Deferredtaxliability_rev-2b13fcdb2894415092ae4171dac657df.jpg)